There were some empirical studies that financial statement fraud was. Nach Cresseys Theorie sollen folgende drei Faktoren gemeinsam gegeben sein damit die Wahrscheinlichkeit doloser Handlungen gro wird.

Anchin In The News Understand The Fraud Triangle To Help Combat Occupational Fraud

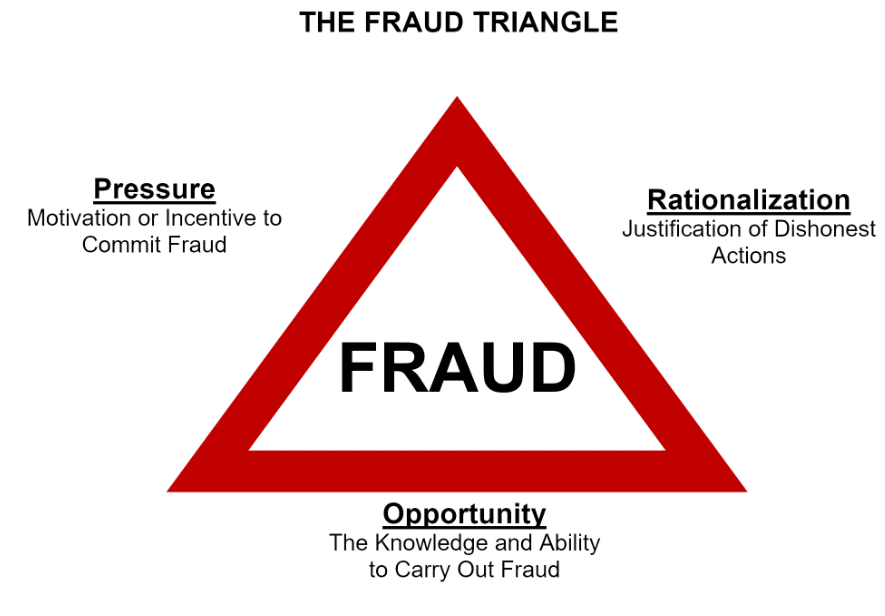

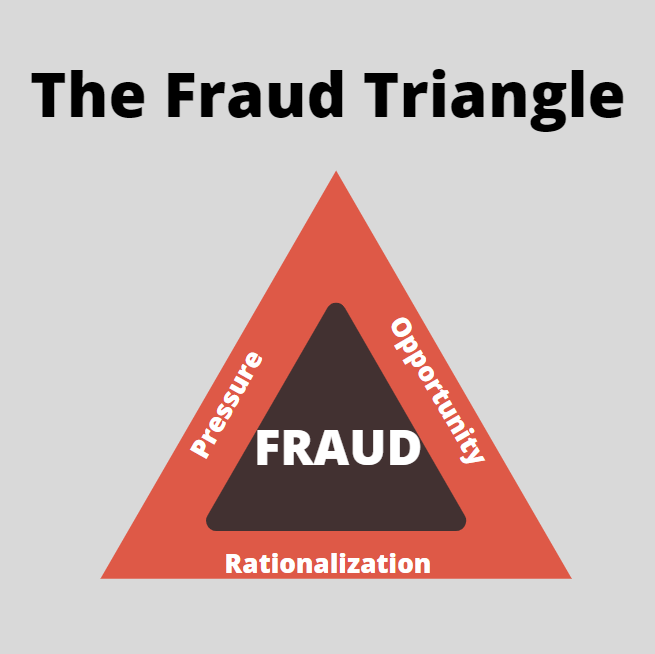

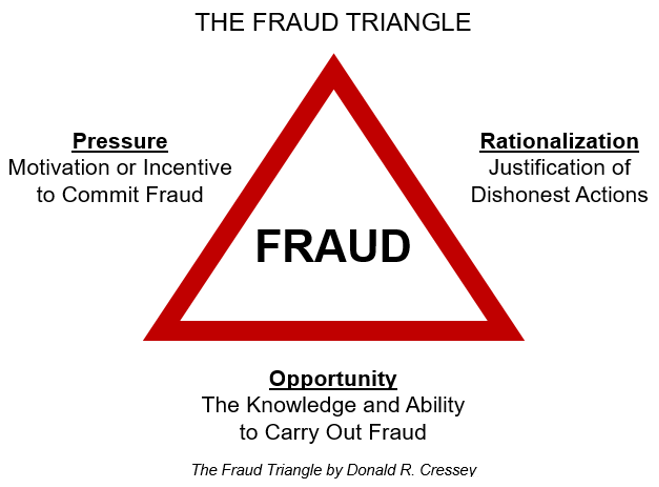

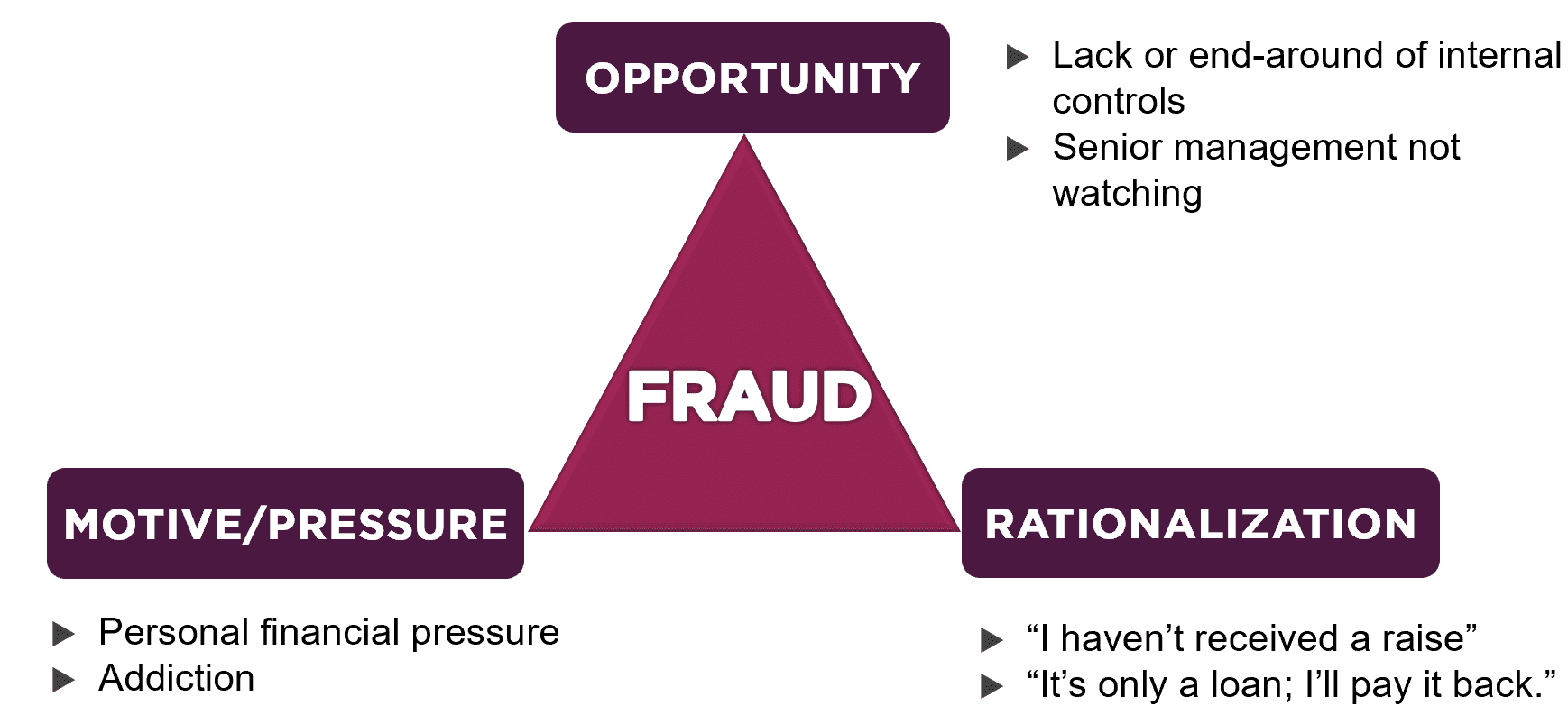

Factors of the fraud triangle can detect fraudulent financial statements.

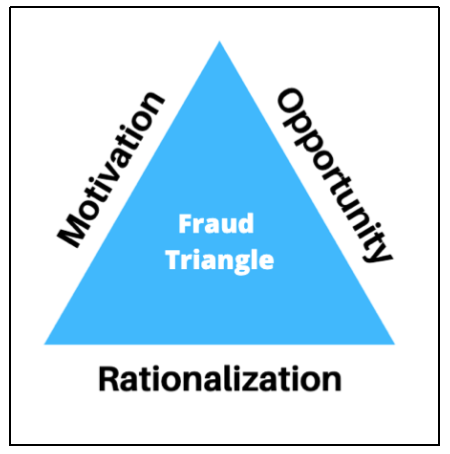

Accounting fraud triangle. A company can falsify its financial statements by overstating its revenue or assets not recording expenses and under. For fraud to occur three components must also exist. And so today let me share a little thing called the fraud triangle.

The combination of perceived pressure rationalization and perceived opportunity necessary to commit fraud. Cressey entwickelt das Betrugs-Dreieck Fraud Triangle das nach wie vor als Frhwarninstrument in Organisationen angewandt wird. Not that never theres no Nevers but the likelihood is less.

It is assumed that this last group of accountants might be potential perpetrators of accounting fraud. Check my website for additional. Unter welchen Voraussetzungen knnen Menschen dolose dh.

Das dolose Dreieck hat folgende Eckpunkte. Criticisms notwithstanding the fraud triangle has endured and has formed the basis of fraud theory since its origination to this day. A ein subjektiv empfundenes nicht mit anderen kommunizierbares finanzielles Bedrfnis.

Only 19 24 respondents knew about accounting fraud in other companies. Perceived pressure rationalization and perceived opportunity. Huber 2017 cited that the fraud triangle as it becomes conceived and disseminated with the aid of the anti-fraud career is misused abused contorted stretched out of form and pressed into.

There were few archival studies that examined whether the fraud triangle theory applies to fraud and there was little evidence to support the effectiveness of the fraud triangle in order to predict and detect fraud Skousen et al 2009 2. Once those elements fall into place the idea of fraud becomes more of a possibility. It involves an employee account or the organization itself and is misleading to investors and shareholders.

This article revisits the Fraud Triangle an explanatory framework for financial fraud originally developed by the American criminologist Donald Cressey from his interviews with embezzlers. Dreieck und soll folgende Frage beantworten. Betrug Flschung List Schwindel Unterschlagung und Triangle engl.

While the end goal may be the same all three parts of The Fraud Triangle. Seventy-four percent 95 respondents considered fraud to be important and only 7 9 respondents claimed that accounting fraud is not important to them. The Fraud Triangle presents three factors that can make one consider fraud.

Fehlende oder ineffektive Kontrolle einfache Unachtsamkeit falscher. So typically if one of these is missing fraud will not occur. What is Accounting Fraud.

These conditions include an incentive or pressure that provides a reason to commit fraud personal financial problems or unrealistic performance goals an opportunity for fraud to be perpetrated weaknesses in the internal controls and an attitude that enables the individual to rationalize the fraud. Accounting fraud is the intentional manipulation of financial statements to create a window dressing of a companys financial health. A fraud triangle are the three things that need to be in place in order for fraud to occur.

At an individual level Auditing Standards Board indicates that the occupational fraud triangle comprises three conditions that are generally present when a fraud occurs. The theory originated from sociology literature and was adopted as an empirically valid explanation of fraud describing three necessary conditions for crimes to occur. Yet the elements of the fraud triangle or any geometric shape of choice as originally developed and modified have been misused abused contorted stretched out of shape and pressed into uses for which it was never intended and cannot possibly accommodate.

IN this video I discuss the fraud triangleAre you a CPA candidate or accounting student. Check my website for additional resources such exam questions and. There has been much attention on explaining causes of fraud based around the Fraud triangle the original theory developed by Donald Cressey in 1953 who modified it many times most recently in the early 1970s.

The Fraud Triangle Sours Brumell Group Fraud Risk Consulting Siu Download Scientific Diagram

The Construction Of The Risky Individual And Vigilant Organization A Genealogy Of The Fraud Triangle Sciencedirect

What Is The Fraud Triangle Bestbussinesscircle

It S Accrual World Is Cressey S Fraud Triangle Outdated

Employee Fraud Detection And Prevention Fraud Employee Training Occupational

The Fraud Triangle Sours Brumell Group Fraud Risk Consulting Siu Download Scientific Diagram

The Organisational Fraud Triangle Download Scientific Diagram

Top Accounting Software For Financial Success Business Basics Financial Apps Financial Success

What Is The Fraud Triangle Accounting Internal Controls

Fraud Triangle Opportunity Incentive And Rationalization

The Fraud Triangle And Your Business

Introduction Chapter Why It Is Time To Talk About Fraud Quadrangle Negative Pressure Unethical Rationalization Unsufficient Control Auditing And Moral Erosion Abstract Europe Pmc

Fraud Triangle Fraud Opportunity St Louis Cpa Firm

Fraud Triangle National Whistleblower Center

Fraud Triangle Meaning Elements How This Theory Work

Financial Statement Frauds Amp The Fraud Triangle

Fraud Facts Where The Losses Are Fraud Data Science Accounting And Finance